[ad_1]

By Amitabha Sen

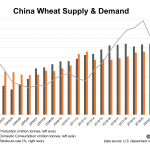

The World’s second largest economic system, China is at the moment holding greater than half of the worldwide wheat shares leaving a lot behind the mixed shares of the US and the European Union’s 27 member states. If excluded China, the worldwide shares can take care lower than two months consumption. That is revealed within the World Financial institution’s meals safety report.

The horrifying “Nice China Famine” in 1959-61 throughout the Mao Zedong period nonetheless haunts the nation’s strongest chief immediately , Xi Jinping, concerning the Meals Safety of over 142 crore individuals within the nation . Additional collapse of the worldwide meals provide chains over the extended Russia – Ukraine conflict is a distinct subject however the truth stays that on the finish of the present 2022-23 advertising and marketing yr (July-June) the worldwide wheat shares are estimated to be 267 million tonnes of which over 50 % is held by China. Of the remaining shares, the US and the EU collectively maintain one other 20 %. The stability about 25-30 % is held by the remainder of international locations on this planet.

“If China is excluded from world totals , projected shares for 2022-23 are 58 days of use“ which is the bottom degree within the final one and a half many years when world wheat inventory stood at 53 days in 2007-08. Alternatively, if shares held by solely main exporting international locations are thought-about, the 2022-23 MY at 26.3 days of use, the bottom fall since 2007-08 MY when shares stood at 25.4 days of use.

“Such tightness of worldwide shares”, the report says “means that worth volatility will proceed to stay greater than up to now 10 years. As well as, within the context of tight world shares, it’s doubtless manufacturing shortfalls in a significant wheat producing area would enhance costs and worth volatility”.

China is at its peak within the worldwide import market and the projected imports are estimated to be 12 million tonnes this yr – close to to 12.5 million tonnes imported in 1995-96. However considerably regardless of holding greater than 50 % of worldwide wheat shares, the home grain costs within the nation are excessive regardless of nation’s “minimal assist worth and lowered public sale exercise amidst uncertainty surrounding the federal government’s COVID-19 insurance policies”, based on a Grain report of the USDA. The report attributes the falling costs – beneath $400 per tonne – within the worldwide wheat market over final couple of months to “ample exportable provides from Australia, The European Union and Canada”.

China’s is attempting to make finest use of the aggressive worldwide costs and importing giant volumes of each milling and feed high quality wheat. Consecutive three years of document wheat crops has led China for “aggressive buy” of wheat from Australia. China’s wheat imports from Australia within the first 8 months of the present advertising and marketing yr was 66 % greater than comparable interval in MY 2022-23. Canada shouldn’t be behind. Its exports of exhausting crimson milling wheat shot up as excessive as 83 % throughout this era.

Presently, many international locations in Africa are having foodgrains disaster. Pakistan can be having critical scarcity of wheat. China with its excessive wheat shares is healthier positioned to provide foodgrains to those affected international locations and earn political mileage as in opposition to its different opponents, particularly the US. Xi Jinping is subsequently displaying confidence in coping with the issues of the disaster ridden African international locations. (IPA Service)

The put up China Dominates International Wheat Market With Its Document Shares In 2022-23 first appeared on IPA Newspack.

[ad_2]

Source link