[ad_1]

PROFILE

BOC

Q: How did your financial institution navigate the challenges posed by the financial disaster?

A: Over its 80 years of existence, BOC has constructed a resilient monetary and operational infrastructure, which is able to absorbing a substantial degree of financial shock.

Because the main banking establishment and a state-owned entity (SOE), BOC needed to shoulder the revival of the economic system by being a part of the federal government’s and Central Financial institution of Sri Lanka’s (CBSL) strategic initiatives to infuse working capital, stabilise rate of interest motion and handle the nation’s international reserves.

Additionally, it needed to deliver revolutionary low-cost involving supply channels to scale back general transaction prices while managing its personal sustainable development.

The financial institution can also be inculcating the saving habits and facilitating monetary inclusion to make sure that all Sri Lankans alike can obtain their monetary objectives.

Q: Inform us your model historical past in short, and model strengths and development potential of your financial institution…

A: Human capital is probably the most distinguished power in any organisation. Our workers perceive the aim of the model and carry out in step with the model goal, which has enabled us to offer maximal profit for all our stakeholders.

The federal government lends the financial institution, being an SOE, stability and safety. Over time, the model has amassed robust monetary and operational capametropolis, which has enabled it to increase throughout the banking and monetary providers panorama.

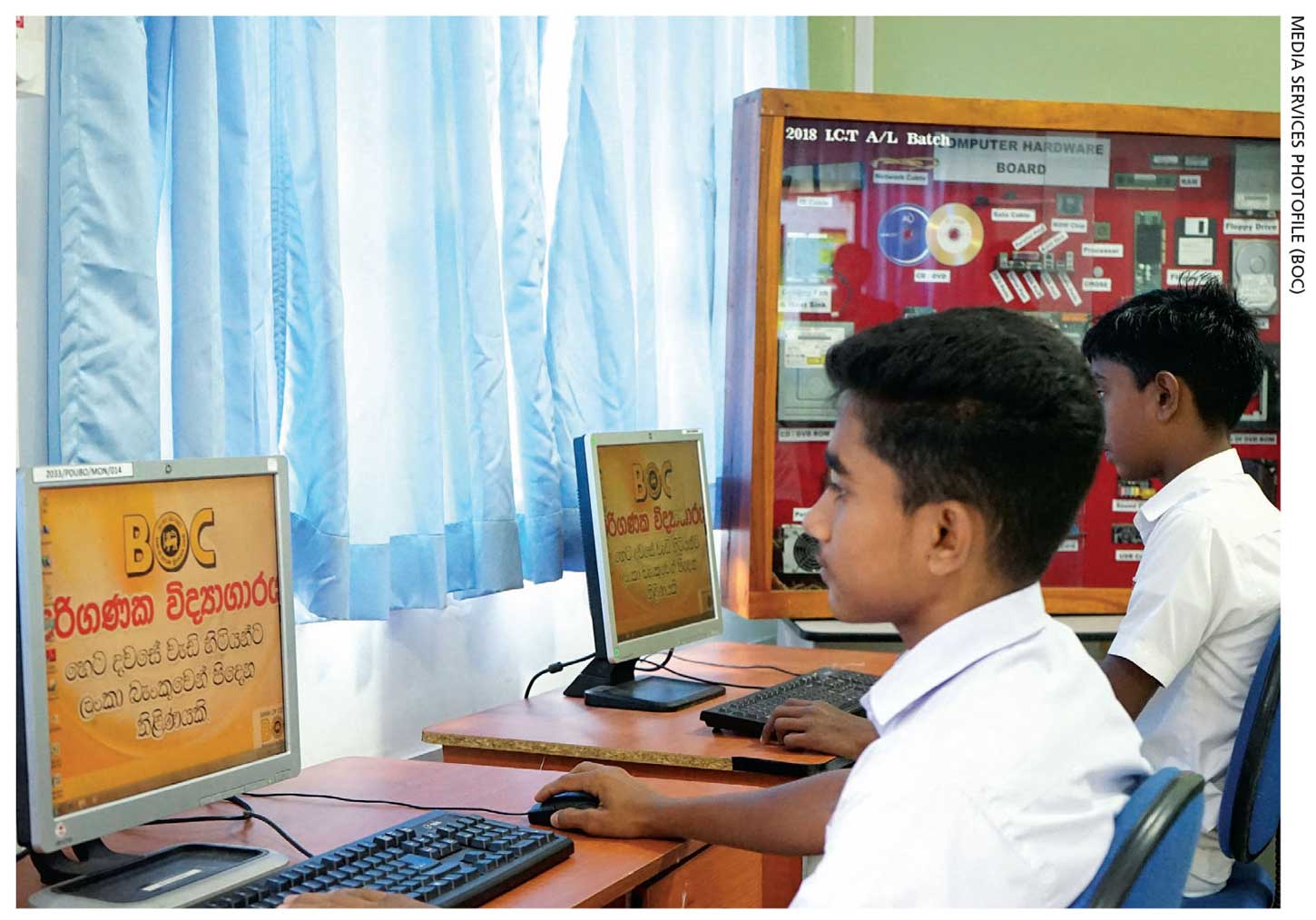

BOC has marked its presence in each nook of this island – with over 2,000 buyer contact factors; has branches in Chennai, Male, Hulhumalé and the Seychelles; and a banking subsidiary in London.

The financial institution has developed a robust worldwide correspondent community comprising 800 international banks and partnering monetary establishments which have enabled it to grow to be the chief in international commerce in Sri Lanka. And the financial institution’s asset base exceeds Rs. 4 trillion whereas it’s reputed as the best revenue earner within the banking sector for years.

BOC has integrated inexperienced banking and nurtured a tradition that’s aware of sustainable development. Its complete infrastructure together with know-how is consistently up to date in response to evolving business developments.

The financial institution has empowered many people and companies by fulfilling their banking wants conveniently and securely, profitable their belief and loyalty because the No. 1 banking model within the nation, which was named ‘Greatest Banking Providers Supplier’ for the third consecutive 12 months on the SLIM-Kantar Folks’s Awards 2023. These strengths on the core of the financial institution allow us to make the perfect of any scenario.

The model identifies how successfully it responds to stakeholder wants and what the route of the model’s development must be

Q: What was the influence of the exterior surroundings on manufacturers and branding?

A: The exterior surroundings is the supply of inspiration for the model to develop sustainably. With steady suggestions, the model identifies how successfully it responds to stakeholder wants and what the route of the model’s development must be. The surroundings decides how a lot the model resonates with the needs and desires of the market, and its degree of acceptance.

Q: What function can model investments play in accelerating enterprise restoration within the prevailing company surroundings?

A: The prevailing company surroundings requires manufacturers to take care of their presence amongst supposed stakeholders to enpositive sustainability. BOC, which has robust stakeholder relationships particularly with clients, requires funding on consciousness constructing, sustaining stakeholder relationships as a company citizen, and speaking model strengths to take care of belief and confidence within the model.

Q: What’s the influence of branding on sustainability and development?

A: Branding, sustainability and development at all times add worth to a enterprise and its stakeholders. As an influence of branding, our stakeholders perceive the values and the aim BOC stands for, which helps us to take care of their belief.

BOC’s stakeholder profile extends to worldwide affiliations, which is clear within the financial institution being named as one of many ‘Prime 1000 Banks’ on the earth and the highest rating Sri Lankan financial institution by The Banker, UK.

Q: How necessary are fame and integrity for organisations?

A: Repute and integrity are constructed over a substantial time interval – with consistency and a deliberate consideration of high quality to construct stakeholder relationships and loyalty. In flip, this brings alternatives for model growth and enhancing monetary capability.

Leveraging on its longstanding fame and integrity, BOC has risen to grow to be the No. 1 banking model within the nation for over 15 years in a row, for its revolutionary spirit and high quality of supply.

Phone 2204444 | Electronic mail boc@boc.lk | Web site www.boc.lk

[ad_2]

Source link