[ad_1]

On August 6, Ukraine printed a coastal notification, declaring the waters of six Russian ports on the Black Sea – Anapa, Novorossiysk, Gelendzhik, Tuapse, Sochi, and Taman – as a zone of “navy risk.” This occurred in response to Russia’s exit final month from a deal that had allowed secure export of Ukrainian grain. Moscow introduced that it will view all ships heading to Ukrainian ports within the Black Sea as carriers of navy cargo, and the international locations beneath whose flags these ships are registered as individuals within the battle on the facet of Kyiv.

The scenario escalated considerably after Ukrainian maritime drones struck Russian vessels close to Novorossiysk and Kerch in early August. Ukrainian President Volodymyr Zelenskyy issued a warning that Russia dangers shedding its ships if it continues to dam the Black Sea waters and the export of grain. Sergey Vakulenko, a nonresident scholar on the Carnegie Russia Eurasia Middle, wrote just lately that the Ukrainian drone assaults on Russian ships close to Novorossiysk and Kerch are a part of a plan aimed toward decreasing Russian exports from Black Sea ports, primarily oil.

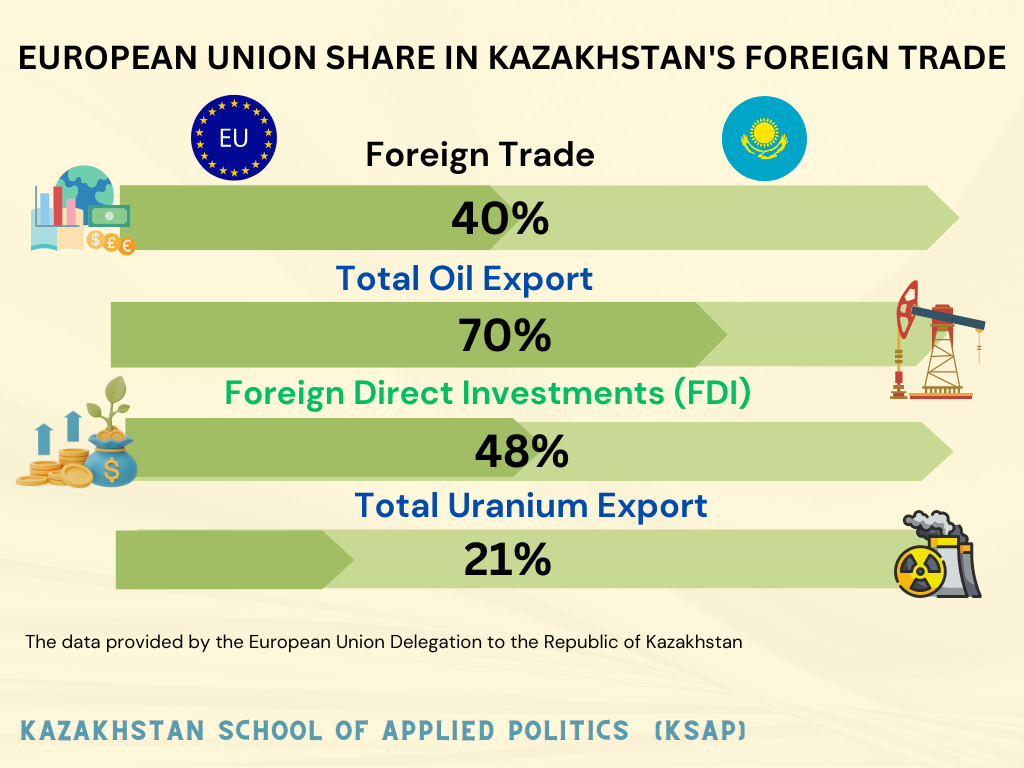

Such vital blows to grease infrastructure may additionally injury the export of Kazakhstani oil. The principle portion of Kazakhstan’s oil exports (round 70 %) are despatched via the Yuzhnaya Ozereevka terminal close to Novorossiysk to European Union international locations. The EU at the moment serves as the first and most essential commerce and financial companion for Kazakhstan. The EU accounts for 40 % of the nation’s exterior commerce and 48 % of whole international direct funding (FDI) influx.

Moreover, Kazakhstan provides 70 % of its exported oil to EU international locations and ranks third amongst non-OPEC members by way of uncooked materials provides to the European Union. The share of Kazakhstani oil makes up about 6 % of whole EU oil imports. Kazakhstan additionally gives 21 % of the uranium imported into the EU.

Contemplating that oil is the first export commodity making certain the influx of international foreign money for Kazakhstan, commerce with the European Union is an important aspect within the structure of the nation’s financial stability and safety.

Considerations concerning the unreliability of transportation and transit routes via Russian territory, via which the export of Kazakhstani merchandise happens, predate Russia’s assault on Ukraine. Sadly, Kazakhstan’s issues with exports to Russia and transit via Russia have been power.

Russia often, in violation of the foundations governing the Eurasian Financial Union (EAEU), unilaterally restricts the entry of Kazakhstani merchandise to its home market, making use of non-tariff regulatory strategies, together with unjustified choices by regulatory authorities organizations (Rospotrebnadzor, Rosselkhoznadzor). Moreover, Kazakhstani items transiting via Russian territory to exterior markets face systematic issues (akin to Russia’s imposition of a quota on the export of Kazakhstani coal via its territory in 2019), usually pushed by political motives. These disruptions often lead to multimillion-dollar prices for Kazakhstan’s financial system.

At current, the scenario has been considerably aggravated by financial sanctions imposed by the West in opposition to Russia and Belarus. This has in the end undermined the long-term, relative stability of the already problematic “Northern Commerce Route” for Kazakhstan. For a few years, whereas having fun with financial consolation and aligning their path with Russian pursuits, the political elite of Kazakhstan usually uncared for critical steps towards diversifying export routes. Because of this, the authorities successfully pushed the nation right into a “transit lure” set by the Kremlin, which had a damaging influence on the nation’s financial improvement and heightened Kazakhstan’s financial and, consequently, political dependence on Russia.

Now the Trans-Caspian Worldwide Transport Route (TITR) mission, passing via Azerbaijan and Georgia, is gaining new momentum. Kazakhstan’s President Kassym-Jomart Tokayev, on the summit of the Council of Cooperation of Arab States of the Persian Gulf (CCASG) and Central Asian international locations held on July 19, 2023, in Saudi Arabia, introduced plans to extend cargo transportation alongside the TITR to 500,000 containers per 12 months by 2030. Compared to the Northern Hall, the TITR (the so-called Center Hall) gives a extra economical and sooner commerce route, decreasing the space by 2,000 kilometers. Moreover, it advantages from favorable climatic and political situations. Good neighborly and partnership relations with Azerbaijan and Georgia (via which the Trans-Caspian route passes), in addition to the political predictability of those international locations, can guarantee extra favorable transit situations for Kazakhstan.

The event of the TITR and different different transport routes might be a big step in making certain financial safety. That is a part of a pure response to ongoing issues with transporting items via Russia. The advantages of the event of the TITR needs to be shared by all of the international locations alongside its route. Among the many major benefits that the collaborating international locations will achieve from the mission, the next might be highlighted: Transit charges and extra revenues; creation of obligatory financial infrastructure to facilitate unhindered transit, together with pipelines, railways, ports, and terminals; elevated geopolitical affect via management over key transit routes; and stimulating the event of the vitality sector via the passage of oil via particular territories.

For Kazakhstan, particularly, the event of the TITR gives broader entry to international markets for promoting oil and different items and accelerated transportation via the usage of Azerbaijan’s developed infrastructure for oil supply and processing, making certain extra environment friendly provide administration. The route additionally diversifies danger: With a number of routes in place, Kazakhstan can scale back the chance of issues or delays in transit.

An essential final result of this mission could possibly be nearer cooperation between Kazakhstan and Azerbaijan, which might have a optimistic influence on numerous points of interplay. This might vary from joint investments in infrastructure and trade of expertise and applied sciences, to strategic strengthening of political, financial, and cultural ties between the 2 international locations.

Sadly, however for fairly predictable causes, the TITR mission faces sturdy opposition from Russia. Just lately, Russian media employed a set of political expertise clichés, describing the scenario as a “sport at midnight.” (One headline, for instance, learn: “A Sport within the Darkish: Kazakhstan is Constructing a Transport Hall round Russia”). This isn’t stunning, contemplating that profitable completion of the mission would strip the Kremlin of an essential leverage level over Astana.

The numerous financial results that Kazakhstan would profit from in creating the TITR wouldn’t favor the Kremlin, which is accustomed to “twisting the arms” of economically weak neighbors.

It’s additionally price noting that the mission comes with its challenges. Among the many main obstacles are the advanced logistics of the route and excessive funding prices for rolling inventory and infrastructure. The logistical complexities contain double transshipment between rail/highway and sea transportation via the Caspian and Black Seas. At present, cargo transportation throughout the Caspian is primarily carried out by Azerbaijani vessels. To attain the declared capability, substantial investments are wanted in transportation infrastructure and the growth of the maritime buying and selling fleet. Moreover, customs inspection occasions should be diminished.

The conclusion of the TITR mission would require not solely financing but in addition sturdy political and diplomatic will, in addition to competent mission administration from the governments concerned.

[ad_2]

Source link