[ad_1]

The NRB has urged lawmakers in Nepal to amend the Nepal Rastra Financial institution Act and the Banks and Monetary Establishments Act to incorporate provisions associated to digital foreign money issuance.

Introduction

Lately, a noteworthy development within the monetary world has been the outstanding rise within the recognition of cryptocurrencies. Cryptocurrencies, characterised by their decentralized nature and lack of presidency regulation, have introduced distinctive challenges when it comes to oversight and safety. In response to those challenges, governments have begun exploring the creation of their very own digital currencies. These government-issued digital currencies goal to carry regulatory management to the digital monetary panorama, making certain the next degree of oversight and security for customers. This proactive strategy seeks to strike a stability between harnessing the advantages of digital foreign money and mitigating potential dangers related to unregulated cryptocurrencies.

Central Financial institution Digital Currencies (CBDCs) signify digital variations of a nation’s official foreign money, issued and assured by the central financial institution. In contrast to cryptocurrencies, CBDCs preserve a steady worth, instantly pegged to the nation’s fiat foreign money. These digital currencies operate as a digital equal of bodily cash, facilitating transactions electronically. Numerous CBDC fashions exist, encompassing account-based and token-based approaches. CBDC initiatives are motivated by a number of aims, resembling enhancing the effectivity and safety of cost programs, fostering monetary inclusivity, stimulating competitors and innovation, enhancing transparency in monetary transactions, decreasing the reliance on foreign currency echange, reducing upkeep prices, and reinforcing monetary stability.

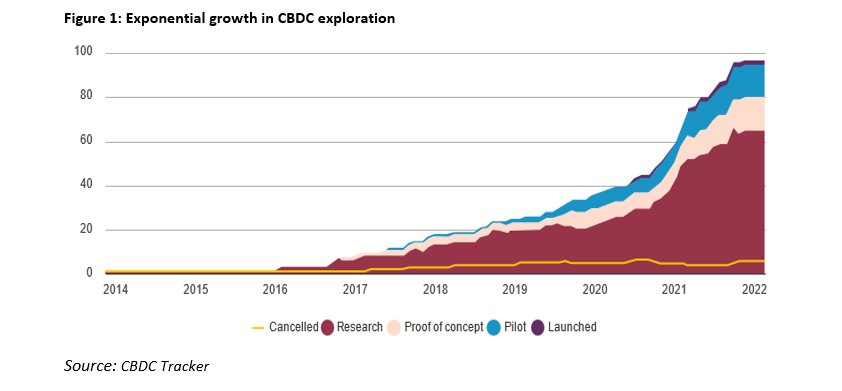

Central Financial institution Digital Currencies (CBDCs) are gaining international recognition, with 130 international locations, representing 98 p.c of the world’s GDP, actively investigating the potential advantages and challenges related to CBDC implementation. The Asia-Pacific (APAC) area has the most important variety of international locations which have CBDC pilots launched, together with Japan, South Korea, China, Hong Kong, India, Singapore, Thailand, Malaysia, and Australia. The APAC area can also be concerned in a number of cross-border CBDC initiatives throughout the area and throughout areas. The Center East and North Africa (MENA) area has a number of international locations actively investigating the potential advantages and challenges related to CBDC implementation. One of many notable CBDC explorations within the area was a joint effort between the United Arab Emirates and Saudi Arabia known as Venture Aber. The European Central Financial institution (ECB) can also be exploring the potential for issuing a digital euro.

Among the many G20 nations, 19 are in superior phases of CBDC improvement, with 9 of them already in pilot phases. Over the previous six months, practically each G20 nation has made substantial progress and allotted extra assets to their CBDC initiatives. Moreover, 11 international locations inside this group have efficiently launched digital currencies, with China’s pilot program, reaching 260 million customers, being examined in over 200 situations, together with public transit, stimulus funds, and e-commerce.

Retail vs Wholesale CBDCs

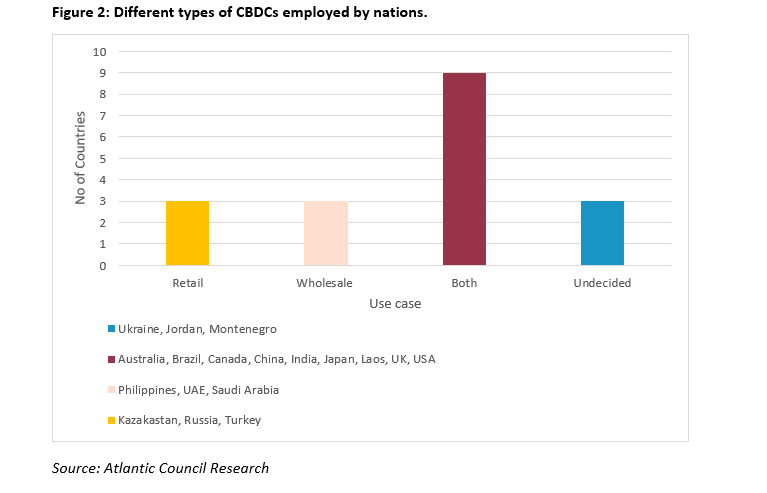

CBDCs are available two main classes: Wholesale and Retail. Wholesale CBDCs goal interbank settlements and large-scale monetary transactions amongst establishments. They excel in dealing with large, rare transactions like settling securities trades and interbank fund transfers. Retail CBDCs, conversely, cater to most of the people and establishments, facilitating quite a few small-value transactions, basically serving as digital money. This type of CBDC can advance monetary inclusion by offering easy accessibility to central financial institution cash for these with out conventional banking companies, but it additionally raises privateness issues because of its widespread public use.

On this context, a 3rd class generally known as Hybrid CBDCs emerges, combining options from each wholesale and retail CBDCs. Hybrid CBDCs supply a flexible strategy that may enhance monetary inclusion by offering safe digital foreign money for people whereas concurrently enhancing the effectivity and safety of economic establishments and markets. This revolutionary center floor throughout the CBDC spectrum goals to strike a stability between accessibility and privateness, doubtlessly revolutionizing the digital foreign money panorama.

Nepal and CBDC

Nepal and CBDC

Nepal’s journey into the realm of CBDCs begins with a complete analysis part. The Nepal Rastra Financial institution (NRB), is actively finding out the feasibility and implications of introducing CBDCs into its monetary ecosystem. This analysis entails a deep dive into the technical, financial, and regulatory features of CBDC adoption. NRB just lately is planning to take a big step by establishing a devoted division inside its Cost Methods Division. The first goal behind this transfer is to pave the way in which for the potential introduction of digital foreign money in Nepal within the close to future. NRB’s strategic plan contains initiating a pilot testing part for the CBDC throughout the subsequent eighteen months. This improvement was influenced by an idea paper on CBDC that the central financial institution revealed in August 2022. In response to the suggestions obtained on this idea paper, NRB is actively working to create the mandatory mechanisms and infrastructure for the eventual launch of digital foreign money within the nation. As a part of this effort, the NRB examine emphasised the significance of creating a definite organizational construction and a specialised group to drive ahead the CBDC mission.

The NRB has urged lawmakers in Nepal to amend the Nepal Rastra Financial institution Act and the Banks and Monetary Establishments Act to incorporate provisions associated to digital foreign money issuance. The NRB emphasizes that for the CBDC initiative to maneuver ahead, a change within the authorized framework is critical. As soon as these authorized amendments are in place, a clearer path for CBDC implementation will emerge. The NRB is eager on exploring CBDCs as they’ve the potential to reinforce cross-border cost effectivity. Initially, the potential for utilizing a Wholesale CBDC is being thought-about, though the ultimate resolution will rely upon suggestions from related establishments. The NRB believes that the success of CBDCs hinges on public and enterprise adoption, with CBDCs getting used for settling transactions, very similar to conventional banknotes or industrial papers.

The introduction of a CBDC in Nepal affords a number of alternatives and challenges. On the constructive aspect, CBDC has the potential to reinforce cost entry for Nepal’s unbanked inhabitants, bolster the resilience of the cost system by decreasing money reliance and enhancing cross-border cost effectivity, whereas additionally reducing foreign money administration prices for each the central financial institution and monetary establishments. Moreover, CBDC can play a pivotal position in selling monetary inclusion, streamlining clear welfare distribution, and combating monetary crimes resembling cash laundering and terrorist financing. Nevertheless, vital challenges should be addressed, together with the necessity for authorized reform to empower the central financial institution for CBDC operations, conducting a complete feasibility examine to evaluate financial, technical, authorized, operational, and scheduling features, initiating a public consciousness marketing campaign for public acceptance, substantial investments in upgrading Nepal’s system infrastructure, and making certain interoperability with home cost programs to facilitate entry to the Indian rupee, requiring coordinated efforts between Nepal and India.

In conclusion, whereas implementing a CBDC in Nepal holds nice promise for monetary accessibility, resilience, and transparency, it additionally presents vital challenges. Addressing authorized boundaries, conducting thorough feasibility research, and gaining public assist are essential for realizing CBDC’s full potential. Moreover, investing in infrastructure and reaching interoperability with neighboring nations are important for profitable implementation. Nepal’s cautious consideration of CBDC’s benefits and complexities will form its monetary future.

[ad_2]

Source link