[ad_1]

After current launches in the UK and Eire, workforce administration platform Rippling is continuous its bold worldwide enlargement with the opening of its Asia-Pacific headquarters in Sydney, Australia at the moment. The corporate, which already has 10,000 clients and is valued at $11.25 billion, will make investments tens of millions of {dollars} in its APAC enlargement, co-founder Parker Conrad (pictured above) tells TechCrunch, and already has 30 individuals in its Sydney workplace, with plans to rent extra for its gross sales, advertising and marketing and product groups.

The final time Rippling hit TechCrunch, it was when it raised a whooping $500 million in simply 12 hours after the collapse of Silicon Valley Financial institution. The platform combines human sources, IT and finance on single platform, enabling firms to handle operations extra effectively. One of many Rippling’s priorities is R&D and new merchandise created particularly for APAC. Along with its Sydney HQ, Rippling additionally has an workplace in India and is now obtainable in Singapore. Its subsequent APAC launch will likely be in New Zealand, with different markets deliberate. Matt Loop, the previous vp of Asia at Slack, will oversee Rippling’s enlargement all through APAC as its new VP and head of Asia.

Rippling’s entrance into APAC follows launches earlier this 12 months in the UK and Eire, the place its European headquarters are situated. Its Australian clients already embrace SiteMate, Liven, Omniscient Neurotechnology (O8t) and international firms like Notion, Anduril and Anthropic.

Conrad says Rippling expects APAC to generate lots of of million, and ultimately billions of {dollars}, in income. The corporate determined the time was proper to increase into the area as a result of lots of its clients have a number of staff in international locations like Australia and India. Rippling additionally noticed that Australian firms are keen to spend closely on software program and different know-how. Another excuse is that there isn’t an area participant that mixes all of the options that Rippling does.

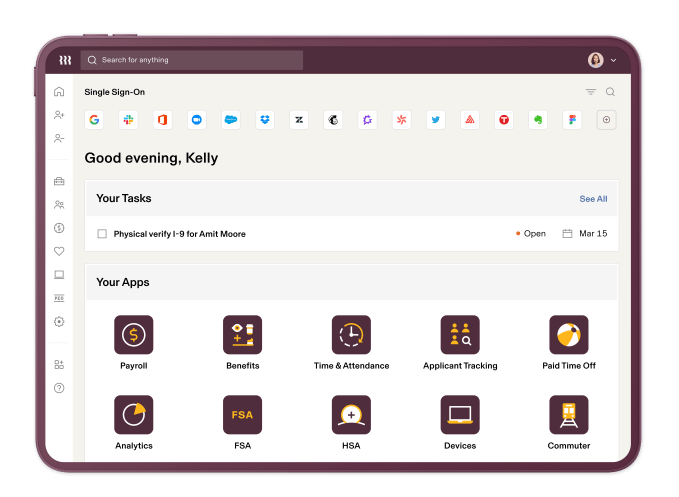

Conrad and co-founder Prasanna Sankar created Rippling as a result of worker knowledge is usually saved in numerous techniques that don’t join with one another, making it troublesome for departments to assist employees, share data or collaborate. By enabling companies to handle HR, IT and finance in a single place, Rippling makes it simpler for them to handle issues like insurance policies relevant to totally different staff, approvals and detailed funds experiences.

Rippling’s residence web page

Conrad says Rippling’s foremost competitor in Australia is Employment Hero. The Sydney-based firm additionally integrates HR, payroll and advantages options and, like Rippling, can also be focusing on international enlargement. However Conrad says Rippling’s benefits embrace a deeper integration between its payroll and HR techniques.

“There’s one native supplier that lots of people are utilizing and we expect that we are able to convey a product to market in Australia that solves a number of issues that employers have with Employment Hero, with a local, deeply-integrated payroll,” he says. One other benefit he says Rippling has is that it’s utilized in 40 international locations, making it simpler for companies to pay worldwide staff.

Conrad provides that Rippling will make investments closely in R&D spending subsequent 12 months and embrace “elementary enhancements” in options like analytics, workflows, permissions, dashboards and expense administration.

“These are usually not simply constructed for Australia,” he says. “They’re constructed globally to work for each nation, nevertheless it makes the product dramatically higher in Australia as nicely.”

Addressing APAC

Earlier than launching in Australia, Rippling localized a number of facets of its platform, particularly in payroll and HR. For instance, it may deal with Trendy Awards, or the doc that states the minimal entitlements Australian staff get from their job. Rippling is ready to assist a employee’s Trendy Awards by way of its HR system for issues like go away administration, pay and advantages. It additionally handles superannuation, or office pensions, tax file numbers and different facets of employment in Australia.

One other facet of localizing helps employers take care of compliance, particularly as laws and legal guidelines change. In Australia this contains the comparatively current Closing the Loopholes Act which, amongst different issues, set minimal requirements for “employee-like” employees and creates new definitions for informal employees.

Rippling co-founder Parker Conrad

Conrad says Rippling has already constructed an underlying system that may deal with compliance in new locations. For instance, the corporate typically enters a brand new market and discovers that their laws are just like ones in, say, France or the US. When Rippling encounters new sorts of laws, it builds these capabilities additional down the stack, so it may be tailored for different international locations.

“On account of that, it’s gotten to the purpose the place as we launch in new international locations, it’s not that tough for us to do it,” he says. “Plenty of the issues that we’re constructing, we don’t truly should construct. Now we have to assemble nearly like a recipe from the underlying capabilities. In order that makes it loads quicker and likewise makes the system extra highly effective as a result of it means issues that may take a very long time for an area firm to construct exist already in Rippling.”

Rippling usually works with firms which have as much as 1,000 staff, however is now additionally closing in on ones with 3,000 staff. Its different rivals embrace Paycom and Paylocity, however Conrad says they solely compete with them in the US. In Australia, Rippling’s foremost rival is Employment Hero, however Conrad says its aggressive benefits embrace constructing a wider product suite that not solely features a HR cloud, but additionally a finance cloud that helps with duties like expense reimbursements and paying payments. On the IT aspect, Rippling can deal with system administration, single sign-on and assist employers handle person provisioning on totally different functions.

As Rippling scales in APAC, its will rent a “moderately massive gross sales group” in Australia to achieve out to firms. It additionally plans to develop the remainder of its Australian group aggressively.

“Rippling actually ought to really feel like an Australian system to anybody that’s utilizing it in Australia,” Conrad says, including, “In every market we’re taking a look at what are the issues we have to combine with, what are the methods we automate issues like retirement advantages, payroll, compliance and that’s the place all of that stuff may be very, very country-specific.”

[ad_2]

Source link