[ad_1]

This time, the federal government’s flagship occasion goals to focus on not solely international buyers but additionally home buyers and non-resident Nepalis (NRNs). The NRN affiliation has begun disseminating the NRN card entitling NRNs to varied funding incentives. Moreover, 11 legal guidelines are slated for modification to deal with venture implementation challenges. The long-awaited legislative adjustments in Nepal’s FDI and funding insurance policies had been accelerated to suit the summit’s timeline.

Introducing the Funding Panorama

Because the anticipation builds for the Third Nepal Funding Summit (NIS) being held in April 2024, the Authorities of Nepal is geared as much as showcase initiatives and alternatives to persuade buyers and herald international direct funding (FDI). Acknowledging that it lacks sufficient inside sources for improvement, Nepal’s financial journey hinges considerably in the direction of FDI. FDI generally is a very important supply of funding within the economic system and subsequently, by funding summits and coverage reforms, the Nepali authorities goals to convey its potential as an investment-worthy nation to buyers worldwide.

Unveiling the Previous

In 2017, Nepal’s inaugural Funding Summit marked a pivotal second because the nation transitioned right into a federal system underneath the brand new 2015 structure. The summit had excessive anticipation. It was in a position to seize the eye of 16 corporations from six completely different nations, subsequently securing international funding commitments of practically USD 13.51 billion, predominantly from China in hydro and cement vegetation. The dedication was greater than half the nation’s estimated GDP of FY 2016/17 AD. The FDI nonetheless didn’t improve as per commitments made throughout the summit.

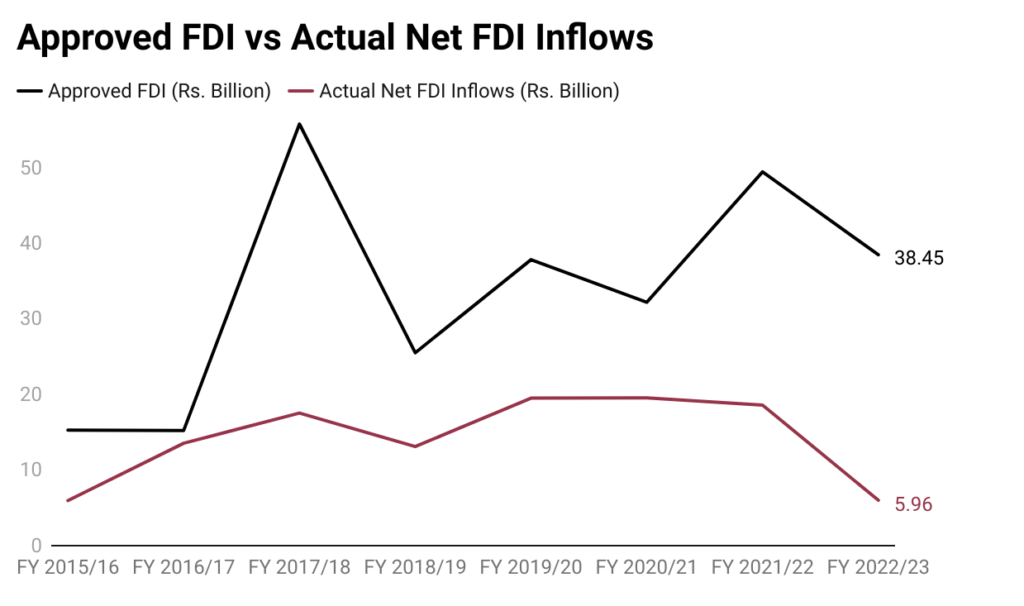

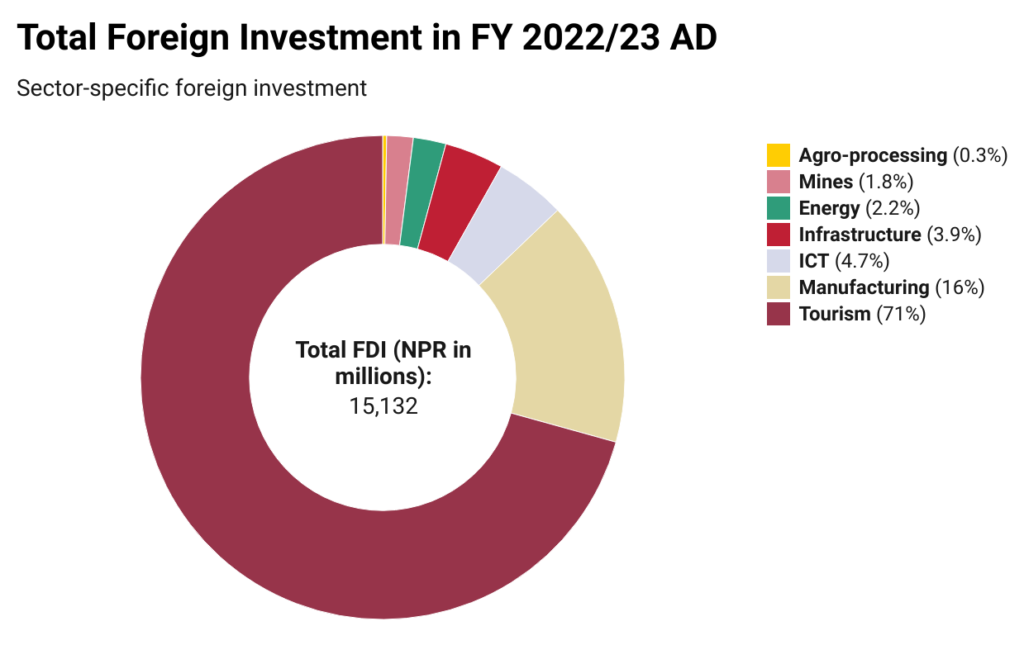

Constructing on the momentum, the 2019 summit was meticulously deliberate with substantial coverage reforms within the Overseas Funding and Expertise Switch Act (FITTA), Firms Act, Particular Financial Zone Act, and Labor Act together with the formulation of a Hedging Coverage to deal with investment-related obstacles. Authorities businesses pledged to behave as facilitators with much less bureaucratic crimson tape. Among the many 50 initiatives showcased by the Funding Board, 15 venture funding agreements had been signed, totalling USD 12 billion. It included Nijgadh Worldwide Airport, Kathmandu Outer Ring Street Venture and others in hydroelectricity and agriculture. Nonetheless, FDI influx fell quick by 30% in comparison with the dedicated USD 17 billion. Notably, in FY 2022/23 AD, whereas the overall funding dedication was NPR 38.45 billion, the precise FDI influx amounted to NPR 5.98 billion indicating a spot in guarantees and actuality. This requires a query: Is the benefit of doing enterprise in Nepal subpar, or are the paper reforms inadequate to persuade buyers?

Supply: Industrial Statistics, Division of Trade and Annual Report, Nepal Rastra Financial institution

Navigating the Current

Supply: Spend money on Nepal 2024

This time, the federal government’s flagship occasion goals to focus on not solely international buyers but additionally home buyers and non-resident Nepalis (NRNs). The NRN affiliation has begun disseminating the NRN card entitling NRNs to varied funding incentives. Moreover, 11 legal guidelines are slated for modification to deal with venture implementation challenges. The long-awaited legislative adjustments in Nepal’s FDI and funding insurance policies had been accelerated to suit the summit’s timeline. One other main reform is relating to viability hole funding (VGF), hedging and Nepal’s nation score regulation. The federal government has been organising pre-events and bilateral conferences with potential buyers globally to make sure alignment within the precise influx and commitments. Another situations of investment-friendly reform embrace the next:

- Opening FDI for journey businesses

- Simplified dividend repatriation

- Permitting 70% FDI in ride-sharing companies

- Relaxed export restriction for SEZ-established industries (from 60% to fifteen%)

- Capability to mortgage as much as 50% of the land for loans

- On-line mechanism for the automated approval of FDI as much as NPR 500 million.

- Discount of the minimal FDI threshold from NPR 50 million to NPR 20 million

- Elimination of the minimal threshold for approval of FDI in IT-based industries

- No approval is required for the reinvestment of revenue generated from international investments

The international funding initiatives in Nepal are plotted within the map under:

Supply: Spend money on Nepal, 2024

Forging the Method Ahead Amidst Challenges

Since NIS 2024 is about to happen at a time when there are governance challenges with the change in authorities simply two months earlier than the summit, doubts are hovering. The buyers may additionally be discouraged by the current exits of main buyers like Axiata (the mother or father firm of NCELL) and Habib Financial institution (considered one of Nepal’s long-standing FDI companions for 3 many years), which may amplify Nepal’s wrestle to draw international investments.

Bureaucratic hurdles stay a big barrier regardless of the state-of-the-art coverage reforms on paper. Implementation efforts may very well be improved. For example, land acquisition points in initiatives just like the Huaxin Cement plant, Dhading and Hongshi Shivam Cement plant, Nawalparasi have led to disputes and time/value overruns. Moreover, even with initiatives just like the Single Window System and on-line registration, buyers are nonetheless burdened with the inconvenience of submitting bodily paperwork by a number of channels. Even with the Funding Board solely devoted to hand-holding and facilitating the buyers, navigating the system stays daunting.

Wanting ahead, doubts have emerged relating to the summit’s relevancy as a consequence of adjustments in authorities. The newly shaped authorities and the funding summit committees carry a heavy accountability on their shoulders to make sure the summit retains its significance and effectiveness.

Forging the Future

Public Personal Partnerships (PPP)

NIS 2024 is onboarding the personal sector to discover potential initiatives and embrace the mantra of Public-Personal Partnerships (PPPs) modelled initiatives. With the enactment of the PPP Act in 2019, important success has been demonstrated in PPP-modeled hydropower initiatives. For instance, Gautam Buddha Worldwide Airport (GBIA), constructed by Northwest Civil Aviation Airport Development Group from China, was absolutely operational in Might 2022, marking it a PPP success. Equally, the Arun III Hydroelectric venture, developed by SJVN Arun-3 Energy Growth Firm Pvt. Ltd. (SAPDC), an Indian authorities subsidiary, has reached a 70% completion milestone as per the timeline. This showcases one other profitable collaboration between the federal government and personal sector in realizing transformative initiatives. Different anticipated PPP initiatives are Nijgadh Airport and, the Kathmandu-Terai quick monitor amongst many extra. PPPs maintain super alternatives for the nation in addition to stakeholders.

Sector-specific Funding Promotion

Every sector has distinctive necessities and the coverage ought to be crafted accordingly. For example, the FDI threshold could prohibit the manufacturing and repair trade because it demotivates small buyers. Equally, to optimally make the most of electrical energy potential, the Nepal Electrical energy Authority (NEA) has not too long ago agreed to purchase electrical energy from smaller buyers as much as the capability of 10 MW. This initiative instantly prompted 89 small buyers to signal contracts with NEA amounting to a further 395 MW of electrical energy in nationwide grid. Additionally, there are prospects for a sustainable power combine with photo voltaic power, and hydrogen power. These signify the potential for sector-specific funding alternatives. Yezdi Nagporewalla, the CEO of KPMG in India additionally suggests Nepal deal with sector-specific funding promotion for higher utilization of potential and subsequently, financial improvement.

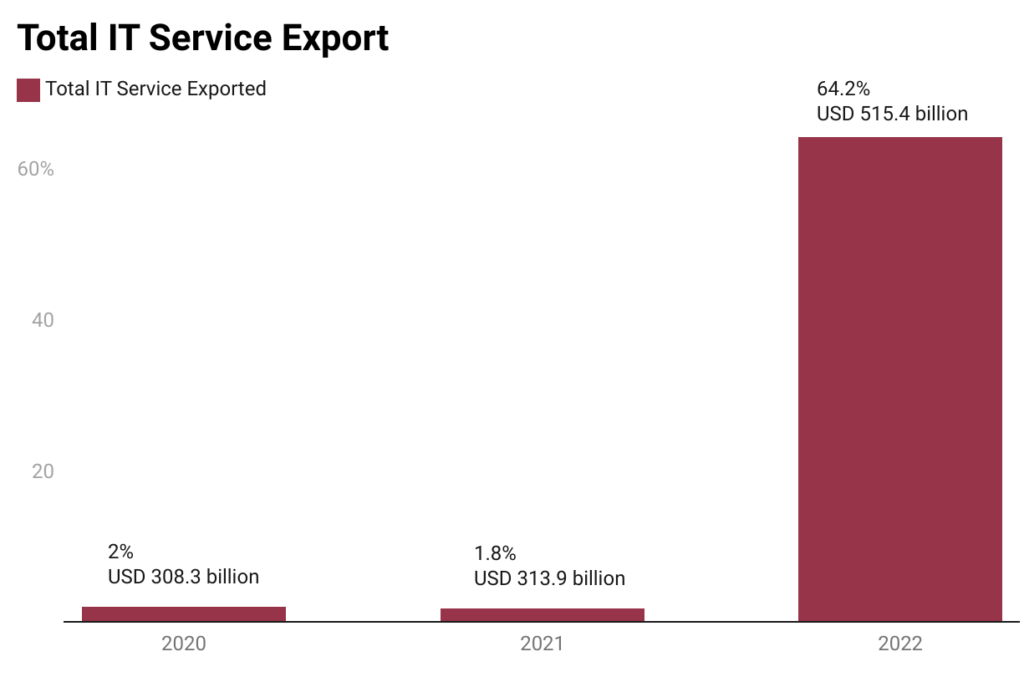

Moreover, the potential funding sectors had been encapsulated within the acronym ‘TEA’- Tourism, Power and Agriculture. The evolving panorama has reworked it into ‘ICE TEA’ – Data, Communications and Expertise – TEA. Latest findings from IIDS highlighted that Nepal’s Data Expertise (IT) service exports marked an annual development price of 64.2% in 2022. The expansion price in IT corporations was 80.5%. In response to this mushrooming potential, the minimal FDI threshold for ICT has been eradicated. Due to this fact, IT-friendly incentives may show worthwhile.

Supply: Unleashing IT, IIDS, 2023

Supply: Industrial Statistics 2022/23, Division of Trade

My take

Nepal has been making progress in changing into self-sufficient in cement and promoting extra electrical energy alongside having related coverage reforms. Whereas the nation has proven resilience in lots of elements, it’s clear that merely internet hosting funding summits and introducing focused insurance policies shouldn’t be sufficient to draw sustainable FDIs. The verbal assurances from the authorities should translate into tangible practices to instil confidence. Traders are searching for predictability and our present enterprise situation screams unpredictability. In essence, whereas challenges persist and never all guarantees could materialize instantly, a steadfast dedication is a should. Simplifying provisions for funding facilitation, venture implementation, operations and revenue repatriation would finest serve buyers. Hopefully, the summit can show to be a testomony to Nepal’s resilience and willpower within the face of persistent challenges.

[ad_2]

Source link