[ad_1]

Cleansing up that construction prompted Stausholm to take two costly steps. With Mongolia’s total GDP a mere $15 billion, the nation’s fairness stake was solely made doable by over $2 billion of historic loans owed to Turquoise Hill. The prices of repaying that debt and the accrued curiosity meant Ulaanbaatar stood to attend many years earlier than receiving dividends from its personal venture. To stem political blowback relating to Rio’s alleged poor efficiency because the mine’s operator, Stausholm agreed a 12 months in the past to write down off that debt.

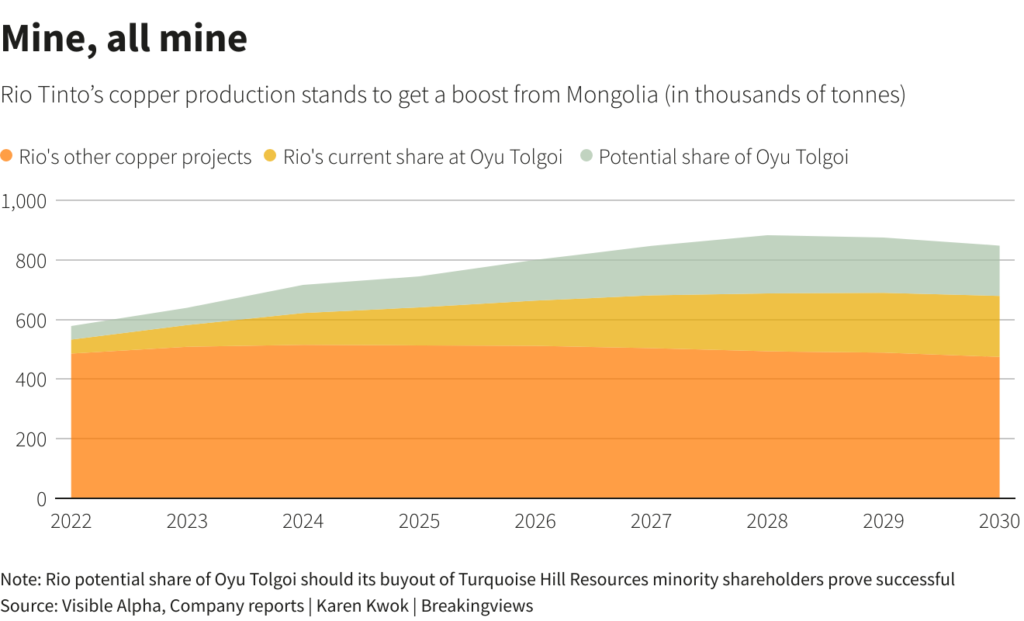

Shopping for out the Turquoise Hill minority shareholders is Stausholm’s different initiative. Rio’s 51% possession means it already consolidates $4 billion of the associated Oyu Tolgoi debt onto its steadiness sheet. A profitable deal would enable it to maintain extra of the earnings and enhance Rio’s world copper manufacturing by 50% to round 900,000 tonnes by 2028. It additionally could be a solution to rid Rio of comparable complaints about its operational efficiency from the minority shareholders.

The method has been a shambles. Earlier than Stausholm’s first provide in March, Turquoise Hill shares had been buying and selling round C$25 ($18.35) apiece, valuing the fairness at $3.7 billion. Some homeowners, together with Pentwater Capital Administration, which now holds a 15% stake, spurned the preliminary 36% premium. In addition they dismissed a sweetened C$40 bid. Even when Rio divulged its remaining provide of C$43 a share in September, valuing the corporate at $6.7 billion, Pentwater and one other refusenik, SailingStone Capital, demurred. Figuring out the truthful worth has a number of solutions, however the dissenters have come near reaching the straightforward majority of non-Rio shareholders wanted to dam the deal.

Then issues acquired actually foolish. In desperation, Stausholm deployed a peculiarity of Canadian securities legislation permitting Pentwater and SailingStone to have their Turquoise Hill valuations decided by an arbitration course of, in return for sitting out the vote. Whereas it wasn’t sure that course of would award them rather more, different shareholders feared the danger of an unique sweetheart deal was too nice. Canadian regulators determined to analyze, which delayed the poll but once more. On Nov. 18, Rio reversed course and scrapped the entire facet deal.

Cease digging

Stausholm appears considerably silly, however he’s not in a hopeless place. Arguably, the minority shareholders should settle for the C$43. In the event that they don’t, the shares might fall again to C$25. Contemplating that pure-play mining shares equivalent to First Quantum Minerals and the copper worth itself have each retreated by 15% since March, Turquoise Hill’s inventory worth may even drop to round C$20.

The Rio boss additionally has a stick, nevertheless. Resulting from price overruns and delays, Oyu Tolgoi faces a funding hole exceeding $3.6 billion. No matter what occurs on the poll field, Stausholm will want cash to get the venture again on monitor. A technique to take action is with a rights problem, which supplies Stausholm the possibility to kill two birds with one stone.

Think about minority shareholders vote down the provide, however Rio then has Turquoise Hill problem recent fairness. Extending the due date on a bit of its debt whereas elevating, say, half the funding hole in shares at a 40% low cost to Turquoise Hill’s present C$42 worth would dilute Pentwater from 15% to 10%, on Breakingviews calculations. The viability of renegotiating the borrowing phrases is controversial, nevertheless. If Rio needed to elevate the complete $3.6 billion at a shrunken C$20 a share and Pentwater as soon as once more declined to take part, its stake would droop to five%.

Given the buyout mess, Stausholm could remorse not choosing a rights problem on the onset. It was all the time obvious Pentwater might need Rio over a barrel. The battle has broken Rio’s board. With minimal internet debt, the miner had sufficient money to purchase extra Turquoise Hill fairness.

Even so, it’s simple to see why Stausholm took an opportunity. Buying the opposite 49% of Turquoise Hill is the one solution to really simplify Oyu Tolgoi. If the roster of pesky buyers merely bought their rights, Rio might need wound up with much more tough companions, whereas nonetheless having to take care of an unbiased board.

These components could save the Rio CEO if he loses the takeover vote, however a failed buyout might nonetheless put stress on Daring Baatar, the pinnacle of copper. He performed a key position in negotiating the current take care of the Mongolian authorities. On the identical time, in a possible signal of the place the blame may fall, solely Baatar was included within the firm’s Nov. 18 press launch ending the ill-fated facet take care of buyers, whereas Stausholm appeared alongside Baatar within the September provide announcement.

The broader lesson is just not that developing-world mining tasks are fraught with problem; they’re what large miners like Rio do. Moderately, the episode illustrates the necessity for a frontrunner with the wits and the gall for roulette. Rio shareholders quickly will see simply how nicely Stausholm performs.

Context information

Turquoise Hill Assets shareholders are scheduled to vote on Dec. 9 on whether or not to simply accept Rio Tinto’s provide to purchase the 49% of the corporate it doesn’t already personal.

Rio must safe two-thirds assist from voting Turquoise Hill shareholders, together with its personal 51% stake, and a easy majority of the remainder of the voting shareholders.

The bid stands at C$43 ($31.64) a share, or simply over $3 billion, after Rio twice sweetened it. Pentwater Capital Administration and SailingStone Capital Companions, which personal respective 15.2% and a pair of.2% stakes in Canada-based Turquoise Hill, have resisted the gives.

Rio operates the Oyu Tolgoi copper and gold mine in Mongolia.

(By George Hay and Karen Kwok; Modifying by Jeffrey Goldfarb and Streisand Neto)

[ad_2]

Source link