[ad_1]

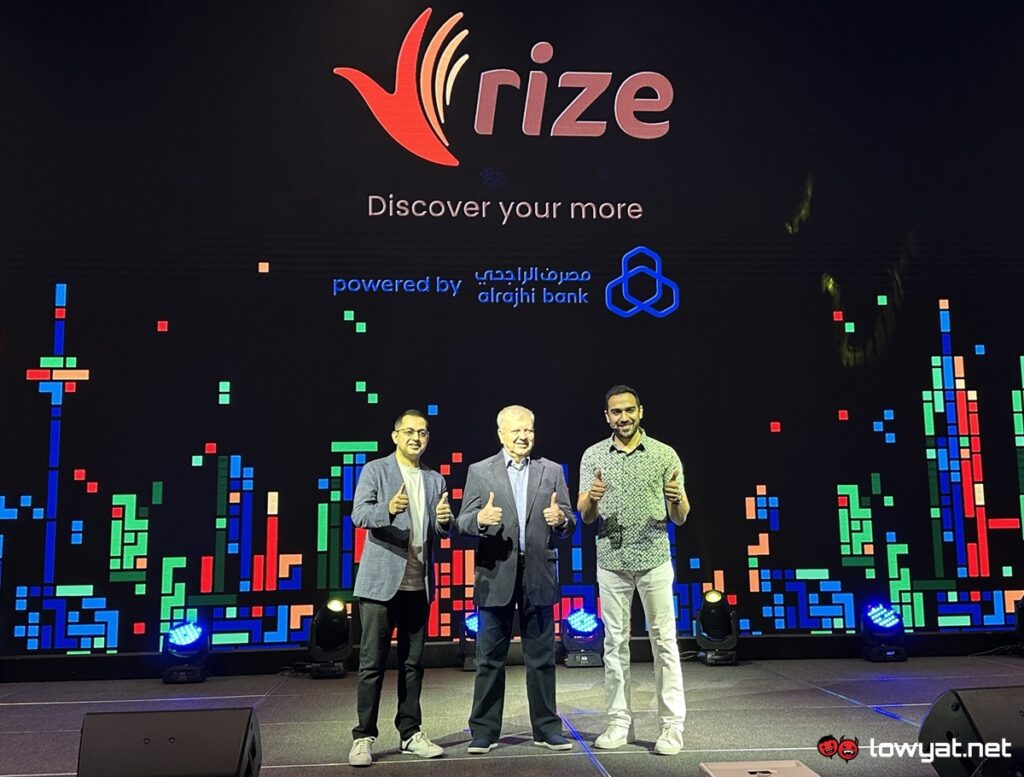

Al Rajhi Financial institution Malaysia (ARBM) not too long ago unveiled Rize which is its new tackle the digital banking expertise. It guarantees a hassle-free totally digital banking expertise with minimal documentation.

Nevertheless, Rize will not be meant to exchange alrajhi@24seven although which is ARBM’s current digital banking app. As a substitute, it’s a separate digital banking platform altogether to the purpose that you need to personal a minimum of one account with one other financial institution in Malaysia earlier than you may truly open a Rize account.

The brand new platform delivers all of its companies solely by means of the Rize cellular app. This additionally applies to buyer assist which has a devoted crew that operated 24/7 in response to the CEO of ARBM, Arsalaan Ahmed.

Based mostly on what we’ve got seen throughout its official launch occasion earlier this month, ARBM appears to place an enormous emphasis on velocity relating to companies on Rize. For instance, the financial institution claimed that it took solely 5 minutes on common for a buyer to enroll in a Rize account though do word that you might want to switch a minimal of RM20 to the account as a way to activate it.

ARBM additionally mentioned that Rize’s Private Financing-i scheme solely requires quarter-hour from the purpose when a buyer begins filling up their utility to having cash of their account. With no processing charge concerned, the financial institution identified that there have been solely 4 steps concerned within the utility course of.

ADVERTISEMENT

Prospects even have the power to create as much as three Financial savings Pots inside their Rize account and since these pots assist a number of contributions, they will rope in exterior events resembling household and mates to chip in simply. They’d additionally obtain income for the financial savings in these pots which is one thing that ARBM claimed as the primary in Malaysia.

Except for having the necessity to have a minimum of one account with different Malaysia-based banks, different necessities {that a} buyer wants to fulfill earlier than with the ability to open a Rize account additionally embrace being a Malaysian citizen with a sound MyKad in addition to being aged 18 years outdated and above.

As Rize assist DuitNow Switch and DuitNow QR, prospects shouldn’t face any problem to switch funds out and in in addition to making easy funds. The digital banking platform additionally has its Monetary Insights part which identifies transactions by means of the usage of AI after which teams them into particular classes.

For now, these are present core merchandise and options that Rize has to supply to shoppers however Arsalaan has assured that there will likely be extra options coming to the digital banking platform very quickly. One such characteristic is a market prospects will be capable of receive complimentary services that fits them.

The Head of Digital Financial institution at ARBM, Ikram Khaliq additionally identified that Rize prospects can even obtain tailor-made gives and reductions primarily based on their monetary habits. To have a good time the launch, early adopters of Rize will likely be supplied with a limited-edition Visa debit card for his or her account.

When it comes to availability, the brand new Rize digital banking app is now available by means of Google Play Retailer for Android customers whereas house owners of iOS gadgets can head on to the App Retailer. The app can be out there for Huawei customers by way of AppGallery.

Observe us on Instagram, Fb, Twitter or Telegram for extra updates and breaking information.

[ad_2]

Source link