[ad_1]

Having a shadow credit standing would assist Nepal determine areas of coverage and governance it may enhance on to obtain a greater sovereign credit standing.

The sovereign credit standing is an evaluation of the creditworthiness of a sovereign entity. That is utilized by traders to evaluate the dangers related to worldwide bonds issued by the nation together with offering a basic concept about funding surroundings of the nation. At the moment, 132 out of 193 sovereign international locations have a credit standing assessed by both one of many three main credit standing companies: Commonplace & Poor’s, Fitch, and Moody’s.

Nepal doesn’t have a sovereign credit standing but, however the nation did try to acquire one in 2019. The Authorities of Nepal hoped to ascertain a sovereign credit standing earlier than the Funding Summit 2019 however couldn’t acquire one resulting from time constraints.

Advantages of a sovereign credit standing in Nepal

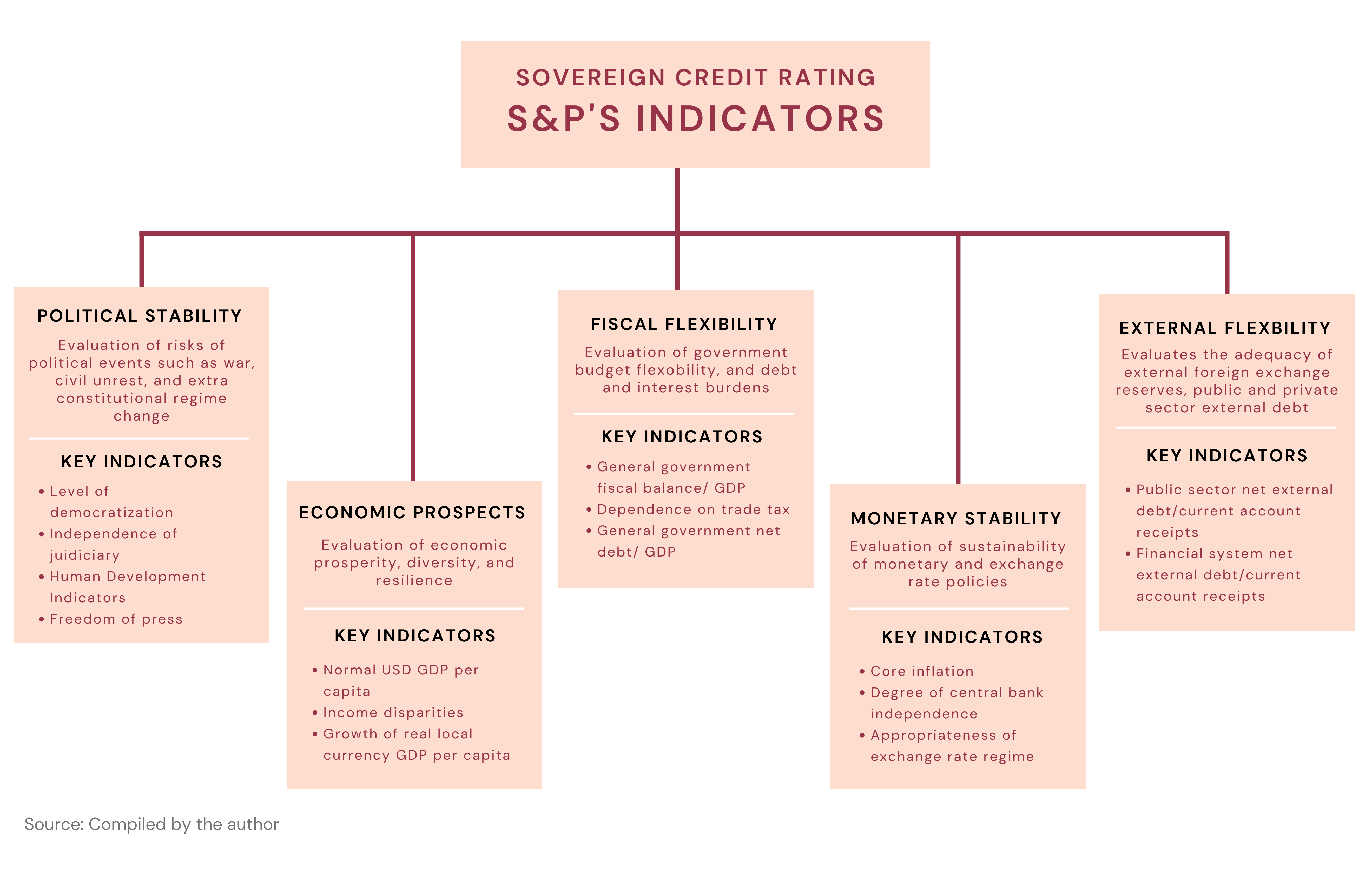

Determine 1. S&P’s Sovereign Credit score Score – Determinants and Key Indicators

Securing a very good sovereign credit standing makes it simpler to concern bonds within the worldwide market at a less expensive rate of interest and decrease price of issuance. The sovereign credit standing additionally helps entry performance-based assist, and concessional loans provided by Growth Monetary Establishments (DFI).

Nepal’s excellent debt accounted for 40.16% of the nation’s GDP in 2020, which isn’t very excessive. This places Nepal able to boost funds for growth of social and bodily infrastructure by issuing international bonds. Additional, the issuance of international bonds may help assist in international foreign money administration since international bonds are issued in foreign currency echange. Provided that the sovereign credit score rankings consider the political and financial scenario as nicely, non-public traders can have larger confidence within the stability of returns their investments in Nepal may present. The Authorities of Nepal’s need to introduce sovereign credit standing simply previous to the funding summit highlights its significance in attracting investments into the nation. Merely having a shadow credit standing would assist Nepal determine areas of coverage and governance it may enhance on to obtain a greater sovereign credit standing.

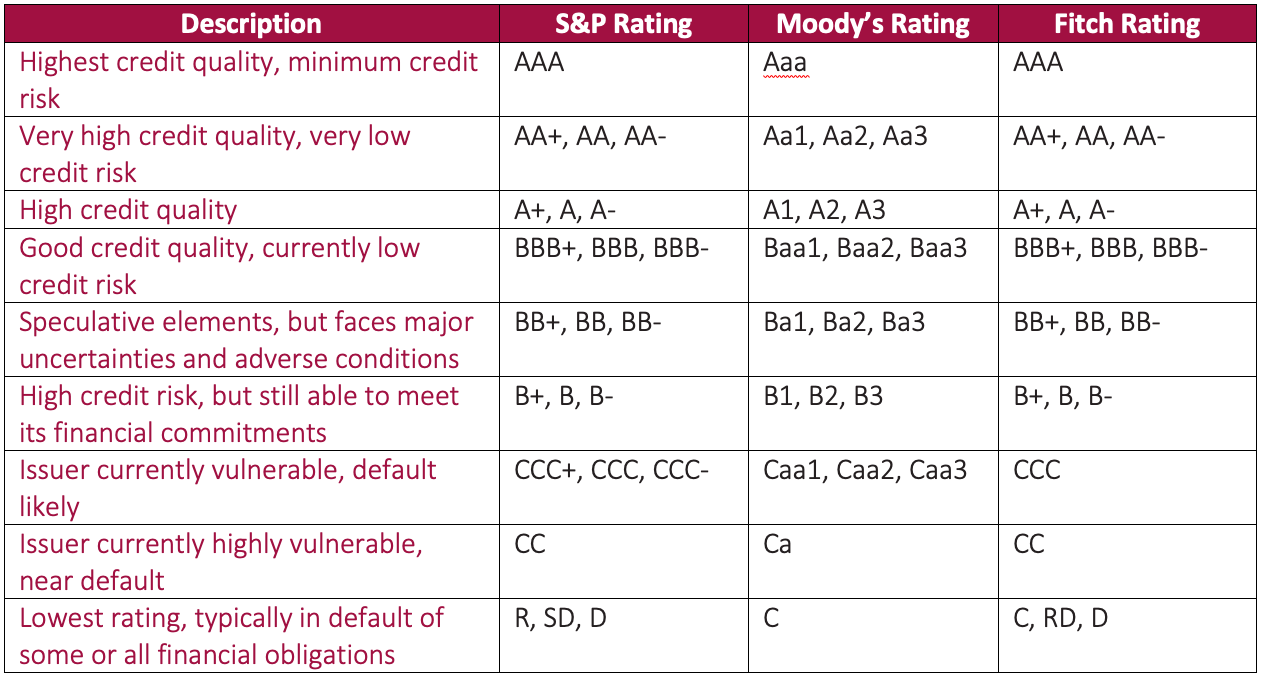

Determine 2: Description of credit score rankings awarded by Prime 3 ranking companies

Supply – Knowledge extracted from a number of sources; compiled by the creator

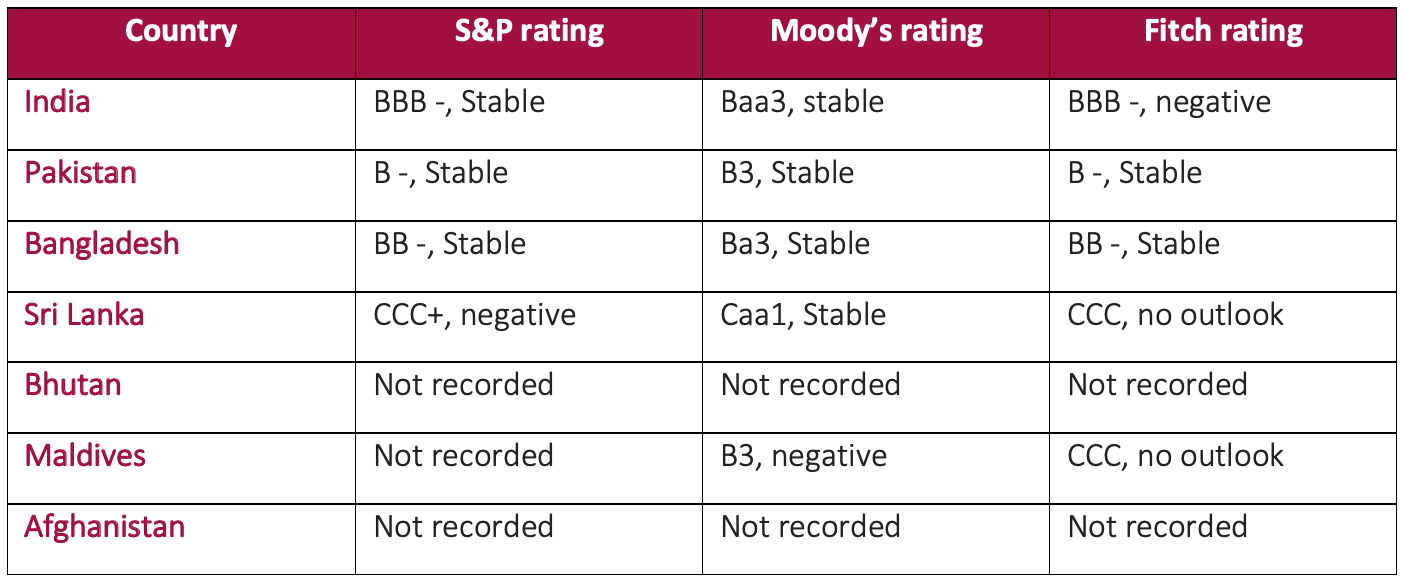

The World Financial institution’s 2013 working paper on the sovereign shadow ranking of unrated international locations confirmed that Nepal would have a ranking of CCC with a constructive outlook, which means that Nepal is weak and can seemingly default. Regionally, this is able to put Nepal in the identical ranking class as Sri Lanka. The sovereign credit score rankings of the South Asian international locations are introduced in determine 3.

Determine 3: Sovereign credit standing of South Asian international locations

Supply – Buying and selling Economics

What may Nepal’s credit standing be based mostly on?

As seen in Determine 1, the sovereign credit standing is evaluated when it comes to key indicators below completely different classes. A number of the components that decide sovereign credit score utilized by S&P are examined beneath to watch the change in indicators since 2013.

For political stability, stage of democratization, corruption, and human growth are key determinants. Within the Democracy Index 2021, revealed by the Economist Intelligence Unit, Nepal ranked 101 with a rating of 4.41 out of 10. Nepal had a rating of 4.77 out of 10 in 2013. In each 2013 and 2021, Nepal’s rating fell below the hybrid regime class of the Democracy Index, which incorporates international locations with election irregularities. Regardless of that, a slight enchancment of rating exhibits constructive change in democracy over time. Within the Corruption Notion Index, Nepal has proven a slight enchancment with a rating of 31 out of 100 in 2013 and 33 out of 100 in 2021. Nepal ranked 116 out of 177 international locations in 2013 and 117 out of 180 international locations in 2021. Additional, Nepal’s Human Growth Index worth for 2019 is 0.602 rating 142 out of 189 international locations, which is an enchancment from the rating of 0.537 in 2010.

Financial prospect is evaluated largely when it comes to projected nominal USD GDP per capita. The nominal USD GDP per capita of Nepal is forecasted to achieve USD 1580.37 by 2026. Nepal’s nominal USD GDP per capita has elevated to USD 1155.14 in 2020, in comparison with USD 823.36 in 2013. Inside this indicator, revenue disparities will be measured by the Gini Coefficient with figures nearer to zero which means good equality. Nepal scored 32.8 in 2010, as measured by the World Financial institution, which reached 39.5 in 2018, exhibiting a declining stage of revenue inequality.

Key efficiency indicators for fiscal flexibility cowl the projected ratio of presidency fiscal steadiness to GDP in addition to reliance on commerce taxes. The ratio of presidency fiscal steadiness to GDP was -3.21% in fiscal yr 2012/13, which has grown to -7.59% in 2019/20. The dependence on commerce tax has decreased to 17.68% of complete tax income in 2019/20 in comparison with 21.96% in 2012/13. Additional, the projected ratios of basic authorities debt to GDP, and basic authorities gross curiosity funds to basic authorities revenues can be used to evaluate fiscal flexibility. There was a rise in authorities debt to GDP ratio from 27.97% in 2012/13 to 36.27% in 2019/20. The ratio of presidency curiosity fee to income has seen a slight improve from 0.25% in 2012/13 to 0.32% in 2019/20.

The financial stability is decided when it comes to projected core inflation fee based mostly on shopper costs. The buyer value inflation fee was 9.9% in 2012/13. The brand new financial coverage aimed to include inflation at 6.5% in 2021/22. Nonetheless, with the continued rise in gasoline costs and elevated pressure on provide chain post-lockdown, Nepal’s inflation has reached 7.14% in March 2022. For the reason that present inflation is brought on by components past Nepal’s management, the nation has carried out nicely on this class. The independence of the central financial institution can also be essential for financial stability. The current suspension of the Governor of Nepal Rastra Financial institution by the Finance Minister may forged doubt on the independence of the central financial institution from political interference.

Moreover, Nepal has climbed 14 locations larger within the international danger rankings since 2018 and 24 locations larger in comparison with the previous 5 years within the Euromoney Nation Danger Index. The index is an alternate ranking that depends on consultants to evaluate a rustic’s danger and is usually used as a dwell indicator of sovereign danger. This might additionally point out that Nepal is able to obtain a greater ranking.

Outlook

Though Nepal exhibits enchancment in just a few elements of the symptoms below the sovereign credit standing, the enhancements are minor and efficiency on different indicators has worsened. On this regard, Nepal may get a better ranking of CCC+ as per S&P’s requirements, however would nonetheless seemingly stay within the class of weak and prone to default on its international bonds. Nepal can draw learnings from different South Asian international locations and devise insurance policies which might be focused in the direction of the development of particular indicators.

Regardless of Nepal receiving a low sovereign credit standing, having any credit standing may very well be higher than having none. It is because traders can regulate their rate of interest requirement to compensate for the upper dangers. This may guarantee Nepal nonetheless will get the funding that it requires, albeit at excessive price. Alternatively, Nepal may suggest for a shadow credit standing from any of the credit standing companies to evaluate the place it stands when it comes to its default dangers. On the very least, Nepal can monitor areas of governance and insurance policies on which it may enhance from the shadow credit standing, resulting in a greater credit standing sooner or later.

[ad_2]

Source link