[ad_1]

Taking the occasional loss comes half and parcel with investing on the inventory market. And sadly for Saudi Pharmaceutical Industries and Medical Home equipment Company (TADAWUL:2070) shareholders, the inventory is quite a bit decrease immediately than it was a 12 months in the past. To wit the share worth is down 53% in that point. Nevertheless, the long run returns have not been so dangerous, with the inventory down 1.9% within the final three years. Shareholders have had an excellent rougher run recently, with the share worth down 32% within the final 90 days.

After dropping 10% this previous week, it is price investigating the corporate’s fundamentals to see what we are able to infer from previous efficiency.

See our newest evaluation for Saudi Pharmaceutical Industries and Medical Home equipment

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share costs don’t all the time rationally mirror the worth of a enterprise. By evaluating earnings per share (EPS) and share worth adjustments over time, we are able to get a really feel for a way investor attitudes to an organization have morphed over time.

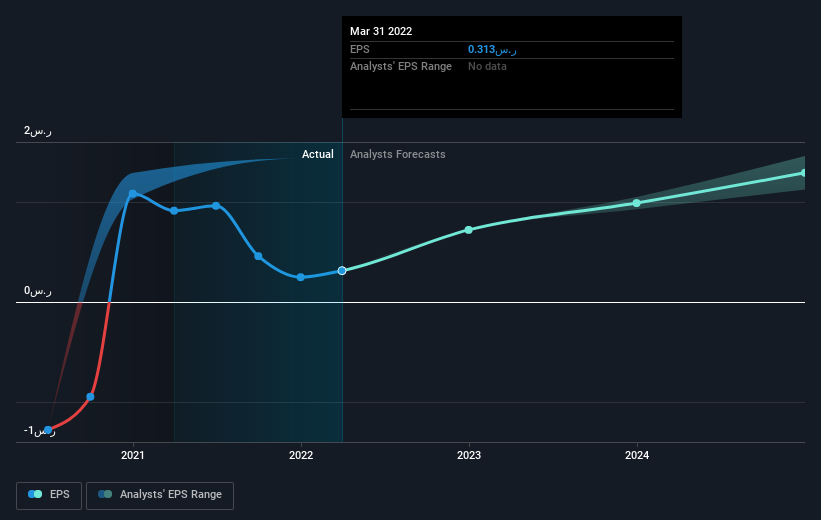

Sadly Saudi Pharmaceutical Industries and Medical Home equipment reported an EPS drop of 66% for the final 12 months. The share worth fall of 53% is not as dangerous because the discount in earnings per share. So the market is probably not too frightened in regards to the EPS determine, in the mean time — or it could have anticipated earnings to drop quicker. Certainly, with a P/E ratio of 82.87 there’s clearly some actual optimism that earnings will bounce again.

You may see beneath how EPS has modified over time (uncover the precise values by clicking on the picture).

We all know that Saudi Pharmaceutical Industries and Medical Home equipment has improved its backside line over the past three years, however what does the longer term have in retailer? This free interactive report on Saudi Pharmaceutical Industries and Medical Home equipment’ steadiness sheet power is a superb place to begin, if you wish to examine the inventory additional.

A Completely different Perspective

Saudi Pharmaceutical Industries and Medical Home equipment shareholders are down 52% for the 12 months (even together with dividends), however the market itself is up 15%. Even the share costs of excellent shares drop generally, however we need to see enhancements within the elementary metrics of a enterprise, earlier than getting too . Sadly, final 12 months’s efficiency might point out unresolved challenges, on condition that it was worse than the annualised lack of 3% over the past half decade. We realise that Baron Rothschild has stated traders ought to “purchase when there’s blood on the streets”, however we warning that traders ought to first ensure they’re shopping for a top quality enterprise. It is all the time attention-grabbing to trace share worth efficiency over the long run. However to grasp Saudi Pharmaceutical Industries and Medical Home equipment higher, we have to think about many different components. Working example: We have noticed 3 warning indicators for Saudi Pharmaceutical Industries and Medical Home equipment you have to be conscious of, and 1 of them is important.

For many who like to seek out successful investments this free listing of rising firms with current insider buying, might be simply the ticket.

Please be aware, the market returns quoted on this article mirror the market weighted common returns of shares that presently commerce on SA exchanges.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We intention to deliver you long-term centered evaluation pushed by elementary information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link