[ad_1]

China has by no means been Sri Lanka’s largest lender. However, as Sri Lanka has fallen into financial woes, notably within the wake of COVID-19, blame has turned to China. Nonetheless, Sri Lankan officers have repeatedly expressed the view that China isn’t the supply of the nation’s financial woes. So what’s the true story?

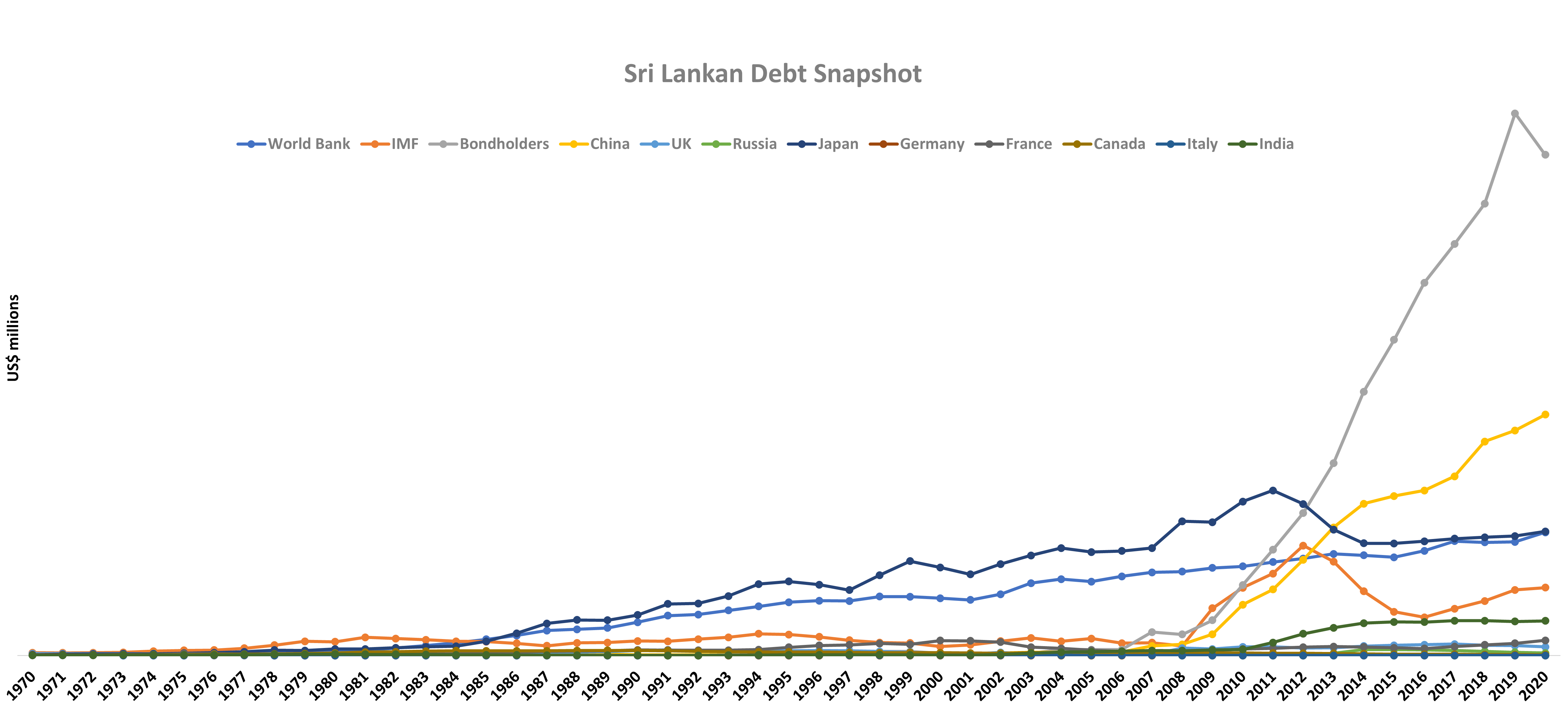

China has definitely featured extra in Sri Lanka’s financial system over the previous couple of years. Again within the early Nineteen Seventies, Sri Lanka borrowed round 4 p.c of its loans from China, and borrowed extra from the U.Ok., Japan, and Germany, at round 17 p.c, 8 p.c, and 6 p.c respectively. At the moment, Sri Lanka additionally borrowed extra from the IMF and World Financial institution – they accounted for round 25 p.c and 9 p.c, respectively, of the island nation’s international debt.

Quick ahead to 2020 and that profile had shifted considerably. Japan and the World Financial institution remained vital lenders at 7 p.c every, however the IMF’s proportion had shrunk to simply 4 p.c, as had the U.Ok. and Germany, which then accounted for round 1 p.c of Sri Lanka’s debt. That they had been changed by industrial lenders (“bondholders”) at 29 p.c and China at 14 p.c.

How did this shift come about and what does it recommend in regards to the position of China in Sri Lanka’s present debt woes?

Sri Lanka – which defaulted on its sovereign debt in Might, the primary Asia-Pacific nation to take action in additional than twenty years – has not confronted a straightforward financial journey because the Nineteen Seventies, regardless of being at some factors seen as an thrilling, rising market.

Between 1983 and 2009 Sri Lanka went by way of a civil warfare, the roots of which prolong again to the colonial period when the nation was often known as Ceylon. Over the civil warfare interval, Sri Lanka’s debt ranges in absolute phrases rose steadily, particularly from the World Financial institution and Japan, and the nation’s debt-to-GDP ratio swung up and down relying on the expansion impacts of the warfare. However, financial progress was pretty constructive, and poverty charges declined from 26.1 p.c in 1990-91 to fifteen.2 p.c in 2006-07. The nation was on target to achieve the Millennium Growth Purpose goal of halving poverty on the nationwide stage by 2015.

Given the constant progress, though Sri Lanka was deemed a “critical concern” in 2005 below the World Financial institution and IMF’s new debt sustainability framework and dominated in 2006 to be technically eligible for debt reduction by way of the Extremely Indebted Poor International locations’ Initiative (HPIC), together with Bhutan, Laos, Kyrgyzstan, and Nepal, Colombo determined to not avail itself of the reduction. Sri Lanka equally didn’t search debt reduction from China. Additional, as tensions decreased domestically, the federal government started to take steps to attempt to additional enhance Sri Lanka’s financial state of affairs by elevating new debt and stimulating progress. That is the place a brand new shift started that explains a number of the present-day dynamics.

From 2007 onward, seeing progress within the agriculture, industrial, and tourism sectors, Sri Lanka introduced itself as an thrilling new vacation spot for world funding, and began to borrow greater than ever, in a rational try and convert the expansion into additional productiveness by way of funding in infrastructure tasks that had appeared inconceivable beforehand. As an illustration, in 2007, pre-dating the Belt and Street Initiative (BRI), the Sri Lankan authorities introduced the concept to construct a port in Hambantota close to the Indian Ocean delivery lane that accounts for greater than 75 p.c of the world’s marine-borne commerce. Forecasting a rising center class in Africa and India and a rising demand for Chinese language items, Sri Lanka wished to snag a proportion of cargo that may in any other case undergo Singapore – the world’s busiest transshipment port. China Harbor Group ultimately constructed the port by 2010; it was funded utilizing a 15-year mortgage of $307 million with a grace interval of 4 years, and a set rate of interest of 6.3 p.c, from China Eximbank. There are different such examples of lending from China.

Alongside this imaginative and prescient, world situations for personal sector borrowing improved. After the 2008 World Monetary Disaster, rates of interest decreased, and with a “average” debt label from the multilaterals Sri Lanka regarded to worldwide sovereign bonds to additional finance spending. Native consumption rose, regardless that worldwide commerce was not essentially rising. Subsequently, regardless of progress and poverty discount, Sri Lanka began to grow to be what is called a twin deficit financial system – an financial system that imported greater than it exported, and spent greater than it was producing.

This might need been a superb technique if it weren’t for exterior shocks. In 2016 and 2017 Sri Lanka skilled a pointy decline in progress, which dropped to the bottom stage since 2001 because of repeated floods and drought. Then a sequence of bomb assaults on Easter Sunday in 2019 lower tourism. In a bid to stimulate financial exercise, and as had been promised within the presidential marketing campaign, the federal government carried out some drastic tax cuts throughout all sectors of the financial system in late 2019. These price the federal government near 800 billion rupees ($2.2 billion). Nonetheless, earlier than the tax cuts may start stimulating the financial system, COVID-19 hit, ravaging the tourism sector, a significant supply of earnings. COVID-19 additionally required elevated spending and elevated imports of well being and different merchandise, exacerbating the commerce deficit.

Overseas forex reserves dropped by 70 p.c, which means much less {dollars} to buy important but more and more costly imports together with gasoline and commodities. To resolve this, the federal government inspired native spending – for instance, on domestically sourced fertilizer moderately than imports of non-organic fertilizers, which had been additionally having hostile environmental and well being results – and printed cash, as many richer nations did. Nonetheless, these strikes all had the impact of accelerating inflation – which reached 60 p.c by June 2022 – whereas farmers ran low on fertilizers, seeds, and pesticides to develop their produce.

Given all this, a key query is whether or not much less lending from China – or every other lender – would have made a lot distinction to Sri Lanka. The reply is unclear, however it appears unlikely, given China’s pretty restricted position in Sri Lanka’s total debt ranges. As well as, the very fact is, nations akin to Sri Lanka want extra finance – not much less – to construct infrastructure to develop diversified, environment friendly and rising economies, and escape the sorts of traps the nation has discovered itself in.

Wanting ahead, what position can China or different lenders play now, if any?

Labeled as a middle-income nation, Sri Lanka isn’t eligible for the G-20’s Debt Service Suspension Initiative nor its Widespread Framework – each of which China is a part of. The Sri Lankan authorities has explored an IMF bailout, however the IMF has stated it can’t assist till there’s “ample financing assurances from Sri Lanka’s collectors that debt sustainability shall be restored.” That is related language to what the IMF has used relating to Zambia (who’s eligible for the Widespread Framework). As a veiled reference to China, the IMF’s language means that if China does point out willingness to restructure current Sri Lankan debt to different collectors, the IMF may present a bailout.

That stated, an IMF bailout will include its personal challenges. The IMF has already indicated it can encourage austerity in Sri Lanka – lowering spending and rising taxes. Sri Lanka didn’t search debt reduction within the Nineteen Nineties or early 2000s for a cause. Moreover, an IMF bailout won’t cut back debt service to Sri Lanka’s largest lenders, bondholders.

However Sri Lanka can nonetheless use its relationship with China in a approach that extra immediately helps tackle the disaster.

Step one is for Sri Lanka to formally request conferences with China to debate cost reductions, past DSSI. All {dollars} or renminbi saved will depend. The second step is to satisfy with different debtors discovering themselves in related conditions – akin to Zambia and Ghana – to strategize about the way to handle each China and different lenders, together with multilaterals and the personal sector. Finally, reform of the worldwide monetary structure is required to make sure debtors akin to Sri Lanka can climate exterior shocks whereas nonetheless spending vital finance on growth.

Lastly, it’s key for Sri Lanka to work with China and different giant economies discover the way to reignite progress, whereas studying from the errors of the previous and avoiding a twin observe financial system. China – as a big world exporter and importer – could be a accomplice in that, however it can take work, and a brand new emphasis within the relationship.

[ad_2]

Source link