[ad_1]

Observe us on Telegram for the most recent updates: https://t.me/mothershipsg

Ranging from Sep. 1, OCBC will elevate the rates of interest for its 360 account in all present bonus curiosity classes – Wage, Save, Wealth (Insure), Wealth (Make investments) and Develop.

As well as, the “Spend” bonus curiosity class has been reinstated for patrons who spend S$500 on the OCBC 365 bank card.

First time since Jan. 2021

The “Spend” class was faraway from the 360 account in July 2020, in accordance with The Straits Occasions.

This marks the primary time OCBC has raised rates of interest since Jan. 2021, after it minimize the charges 4 instances in eight months.

The financial institution’s Head of Wealth Administration Singapore, Tan Siew Lee, was quoted as saying:

“The OCBC 360 Account is compelling not simply due to its aggressive charges however the ease with which our clients can get pleasure from these charges – they will earn bonus curiosity simply by going about their day by day lives, with no acutely aware effort wanted.”

Adjustments taking impact from Sep. 1

Rates of interest

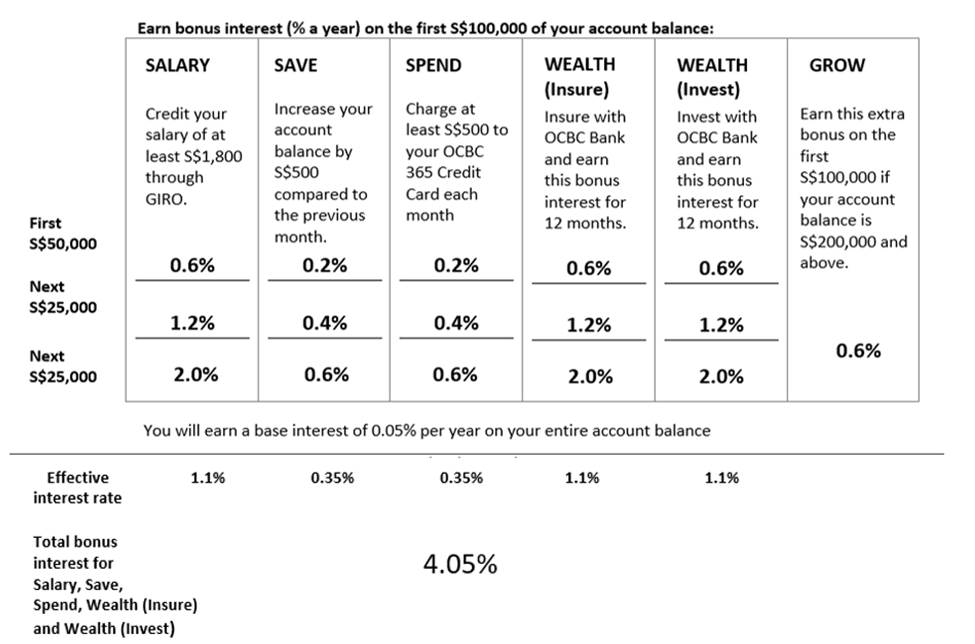

In line with OCBC, customers can earn bonus curiosity on particular person banking transactions.

For instance, crediting their wage into the account will now earn as much as 1.1 per cent curiosity each year, whereas saving S$500 extra a month will earn as much as 0.35 per cent each year.

Prospects are additionally not required to “bundle” these transactions collectively to start out incomes bonus curiosity.

As for patrons who carry out transactions within the bonus curiosity classes of Wage, Save, Wealth (Insure), Wealth (Make investments) and Spend, they will earn bonus curiosity of as much as 4.05 per cent each year on the primary S$100,000 of their checking account.

OCBC additionally highlighted that for patrons who proceed to credit score a wage of not less than S$1,800 into their account by GIRO and saving not less than S$500 greater than the earlier month, clients can earn bonus curiosity of as much as 1.5 per cent each year, up from 0.98 per cent each year beforehand.

A brand new account stability tier has additionally been included and the utmost account stability that clients can earn bonus rates of interest on has been elevated from S$75,000 to S$100,000.

OCBC additional highlighted that the banking standards for the prevailing bonus curiosity classes have stay unchanged.

With regard to the reinstatement of the “Spend” class, OCBC stated that clients can earn rates of interest of as much as 0.35 per cent yearly by spending not less than S$500 on their OCBC 365 bank cards.

Listed below are the tables for the total modifications:

Supply: Picture by way of OCBC

Supply: Picture by way of OCBC

Supply: Picture by way of OCBC

Supply: Picture by way of OCBC

High picture by Joshua Lee

[ad_2]

Source link